16.04.2024

Yuan-Euro-Dollar: a Noxious Trio of Monetary Interventions

Tribune

21 janvier 2016

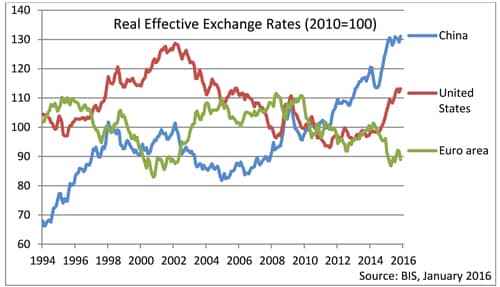

This logic led many, until recently, to keep considering the yuan to be undervalued although the Chinese currency had actually been soaring for a decade (by 60 percent from 2005 to 2015 in real effective terms), reaching highly unsustainable levels. From 2005 onwards, the Chinese authorities orchestrated, most notably under the pressure of the U.S. Congress, a lasting revaluation of the yuan against the dollar (albeit of a lesser magnitude than the even larger surge capital inflows would have implied). The dollar’s sharp appreciation against most other currencies since 2014 has made it all the more necessary for China to regain a certain degree of exchange rate flexibility, so as to curb the decline in its growth rate and to limit the deflationary trends affecting its industry. This step, in turn, is hurting its competitors, which had benefited from the yuan’s strength.

To devalue the yuan, the PBoC is gradually lowering its daily fixing rate according to the trend already set by capital markets, which are massively pouring out of China. In doing so, the central bank introduces more flexibility and more ‘market’ into its exchange rate. Those who campaigned for the yuan’s liberalisation as a means to prevent the Chinese authorities from manipulating the exchange rate downwards see their argument backfire. China is liberalising its currency precisely at a time when market forces are pushing it not upwards, as they had hoped, but irremediably downwards. The authorities’ desire to limit or reverse the yuan’s appreciation is understandable after years of real appreciation. Meanwhile, under the current monetary regime, all major economic areas end up facing this kind of urgency sooner or later, which makes the whole game particularly destructive and unsustainable.

There is some truth in the notion of a global ‘currency war’. Through the imaginary of conquest, it however tends to hide the dire situation facing most economies when their central bank eventually resolves to lower the exchange rate. Until overvaluation reaches extreme levels, most politicians and central bankers tend to cherish the idea of a strong currency, as it is in tune with the anti-inflationary standards currently in force. This trait explains why there is no such thing as a real-time currency war, but a succession of pronounced multi-year long trends, with alternating episodes of massive over-appreciation followed by large depreciation as a result of the ensuing economic instability. In recent years, Chinese leaders had come to view the yuan’s strength as the symbol of a new economic model. This new model was allegedly reflected in significant wage hikes, the off-shoring of lower-end manufacturing to Southeast Asia and more consumption dynamism as an engine of growth. They undoubtedly overlooked the disastrous consequences of the housing bubble and the investment frenzy, as both trends were expected to offset the effects of the global crisis after 2008. Surprisingly, the unprecedented stock market bubble the authorities later encouraged (as the the Shanghai stock market jumped 160 percent in just one year, from June 2014 to June 2015) was supposed to support the challenging transition towards this new qualitative model… through the creation of purely artificial financial income.

China stands out as the yuan’s overvaluation followed a long history of outright manipulation of the exchange rate until the mid-2000s, while the country was experiencing massive trade surpluses. The effects of this policy on the country’s neighbours, during the Asian crisis, and most developed economies, have been widely commented. Whereas this non-cooperative policy eventually sparked outcry, exchange rate manipulation under the guise of monetary stimulus more effectively blurs lines, in difficult times, as in the case of the dollar and the euro. The dollar’s depreciation, as it was orchestrated by the Fed under its successive bouts of quantitative easing, aggravated the situation not only in the euro zone but also and especially in emerging markets. While the latter were particularly affected by weak global demand from 2008 onwards, their high growth rates in the following years led many analysts to back the theory of a so-called decoupling between emerging and developed economies. According to this line of thought, the surge in these countries’ real exchange rates was hardly perilous but symbolized, on the contrary, the advent of a new economic model. Not only has this dynamic proved disastrous in terms of industrial competitiveness; it has fuelled a carry trade of an historic magnitude, the financial consequences of which are a time bomb. If the dollar’s undervaluation has helped the fragile US recovery, its strong rebound since 2014 is no less problematical, this time for the US economy itself (and for emerging markets’ creditworthiness too). Once again the idea that the manufacturing sector has little importance is taking centre stage in economic debates, which are reminiscent of the way the trade deficit issue was often dismissed in the lead-up to the 2007 crisis.

Similarly, the euro’s depreciation, which is being currently implemented by the ECB against the background of its attempt to bring inflation back to its 2 percent target, bears heavy consequences. The block already displays a trade surplus in excess of 3 percent of GDP and Germany close to 7 percent. This situation brings us back to the Euro zone’s fundamental flaws and mismanagement. The euro’s exchange rate in early 2014 was suitable for Germany but not for the countries that were worst affected by the crisis. A genuine internal rebalancing in the ultra-rigid framework of the euro required more substantial wage hikes in Germany—which, at the same time, would have supported a rebound in European inflation. As wage issues are particularly controversial, the ECB of « Super Mario » (as ecstatic golden boys call him) has eventually ventured into devaluation by means of a massive quantitative easing programme. The euro’s sharp fall, coupled with the collapse in commodity prices, has certainly breathed some life into the moribund Euro zone economy, but at the expense of global stability.

Once again, a large economic area, rather than address a concrete economic issue, namely that of intra-European wage dynamics, and the flaws of the euro’s architecture, resorts to massive currency manipulation, which will even fail to solve its own initial problems. Since 2008, the euro’s real effective exchange rate has fallen by almost 20 percent. This is not far from the massive decline experienced by the common currency after its introduction in 1999. This initial drop could not be blamed on European leaders who, on the contrary, viewed it as a humiliating repudiation on the part of capital markets. The euro’s drop meant the dollar’s surge, from an already very high level. From 1995 to 2002 the dollar rose by about 30%, which had devastating effects on US competitiveness. The euro’s rebound, which began in 2002, and the dollar’s fall did not even allow for a rebalancing of the US economy, which barely out of the explosion of the dot com bubble, embarked, with a part of the Euro zone’s periphery, on a monumental housing bubble, with the Fed’s and ECB’s full blessing and support. So-called heroic action on the part of central banks should spark fears of immediate danger.

[1] Christine Lagarde’s speech at the 2013 gathering of central bankers in Jackson Hole provided an illustration of this narrative: “In many respects, central banks have been the heroes of the global financial crisis…”