17.07.2024

Are We Heading Towards a Uranium Shortage?

Tribune

30 janvier 2024

This increase can be explained above all by the renewed interest in the atom, which according to the International Energy Agency is set to play a greater role in the world’s energy mix, as demonstrated by the commitment made by 22 countries at COP28 to triple the world’s nuclear potential by 2050.

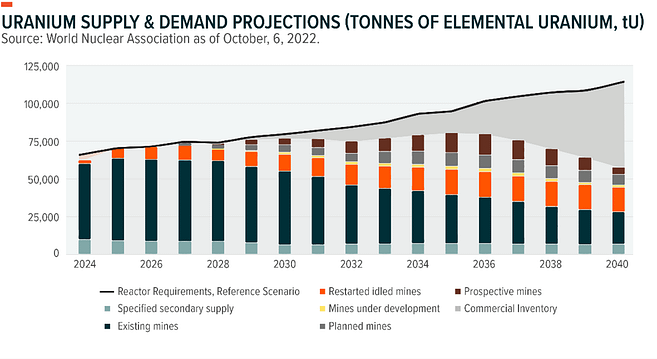

But this enthusiasm comes against the backdrop of a uranium market that some would describe as chronically sluggish, where a succession of nuclear accidents has constantly curbed the development of the industry, while uranium supply has almost systematically exceeded demand, the fault of abundant stocks inherited from the strategic priorities of the Cold War. This discrepancy explains why uranium prices have rarely exceeded $80, and few mines can make a profit at such low prices. As a result, capacity is now limited, while demand is rising rapidly and is expected to increase by 27% between now and 2030.

Against this backdrop, geopolitical factors are exacerbating the uncertainty of economic players and driving up prices. The coup d’état in Niger, the European Union’s second-largest supplier in 2022, is of course fuelling fears. The growing influence of Russia and China is also raising concerns. Both countries have a dynamic nuclear industry with a strong demand for fuel, and make no secret of their commercial ambitions, particularly in the extraction and conversion of uranium.

In Kazakhstan, Russia has been able to maintain its influence over extractive activities. Despite Astana’s distancing itself from the country, the Kremlin continues to hold stakes in the Kazakh mines, which contribute over 40% of the world’s uranium production.

In Namibia, China controls most of the reserves through its state-owned companies, CNNC, CNUC and CGN-URC. As for countries with under-exploited resources, such as Tanzania and Botswana, the two powers have already positioned themselves to finance future projects. As for Niger, which is determined to redirect its exports away from its former partners, China already has a concession there, and Russia is stepping up its diplomatic gestures.

But in addition to these geopolitical and economic factors, there are other issues at stake, starting with the planned diversification of nuclear technologies, between Small Modular Reactor (SMR), Advanced Modular Reacator (AMR) and Small Nuclear Power Reactor (SNPR), which promise more widespread, decentralised and potentially more expensive use of uranium. These prospects also call into question the ability of the nuclear industry, which is by nature concentrated and highly regulated, to adapt to what promises to be a complex energy landscape.

For all that, there is no crisis and even less shortage of uranium in sight. If prices do rise, it will have little impact on the final price of nuclear electricity, since the fuel component is marginal and secured by national stocks and long-term contracts. On the contrary, the upturn in prices is making it possible to relaunch operations that have been closed for lack of profitability. This is the case in Namibia (Langer Heinrich), Canada (McClean Lake), the United States (Christensen Ranch) and Malawi (Kayelekera).

Nor should we accuse China and Russia of wanting to stifle the West’s nuclear capabilities. Not only do they not have the means to do so, but their interests lie first and foremost in satisfying their own needs and developing their attractiveness in a rapidly expanding market in which the West is not the only player. It is also wrong to talk of a Sino-Russian axis, when the two countries are clearly competing to acquire minerals and export their own nuclear technologies.

If there is to be a uranium crisis, it is not likely to happen soon. However, this market upheaval is a reminder that nuclear power, like any source of energy, relies on raw materials and, by extension, imports that can be factors of vulnerability. An unthinkable fact, particularly in France, where uranium supplies are still not included in the country’s energy independence rate.

________________________

Additional ressources:

Alexander Boytsov, « An insider’s view of uranium production: status, prospects and challenges », in Uranium: From exploration to remediation, Bulletin of the International Atomic Energy Agency, ( Vienna: IAEA, June 2018): 28-29.

International Atomic Energy Agency, Global Inventories of Secondary Uranium Supplies, IAEA Tech-doc Series, (Vienna: IAEA, 2023).

Nuclear Energy Agency & International Atomic Energy Agency, Uranium 2022: Resources, Production and Demand, OECD Publishing, (Paris: NEA, 2023).

World Nuclear Association, « Uranium Markets », July 2023.

OEC, « Fuel elements non-irradiated, for nuclear reactors », 2023.

Translated by Deepl.