05.07.2024

Africa at crossroads of a new era of economic diplomacy. The imperative of stepping out of traditional investment patterns

Tribune

25 avril 2019

As China and several emerging economies continue to increase their engagement across the African continent, Europe and the United States put the emphasis on their trade and investment relations as partnerships “between equals” and of “mutual benefit”. From the new U.S. Development Finance Corporation to the Africa-Europe Alliance for Sustainable Investment and Jobs, a new chapter of power competition through economic diplomacy seeks to mix traditional development assistance and other official finance with more private sector investment. Increased investments represent a unique opportunity to further much needed structural change across the continent. Yet, results at country levels will highly depend on the extend to which they enable domestic revenue, local value addition and step out of well-known investment patterns of the past. Otherwise, the big winners may be foreign investors, through high rates of return combined with public guarantees and other support, at the expense of local development gains.

Counting on the firepower of investments in the global development agenda

Against the backdrop of drastic budget cuts in United States foreign assistance since 2017, the passing of the BUILD Act[1], an October 5th, 2018 bill that created a new U.S. International Development Finance Corporation (USDFC), may have come as a surprise to some. Endowed with US$ 60 billion to encourage private sector investment in low and middle-income countries, USDFC has twice the funding cap of its predecessor, the Overseas Private Investment Corporation (OPIC) and will be merged with the USAID Development Credit Authority. Fruit of several years of lobbying from U.S. think tanks to reform U.S. development finance, this new model is part of an increasing use of public guarantees and financial capital to encourage businesses from provider countries to invest in burgeoning economies.

One of the key objectives of the USDFC is to offer alternatives to Chinese investments in developing countries, an ambition that is also largely stressed through the December 2018 Donald J. Trump Africa Strategy which was released jointly with the USAID Private Sector Engagement Policy. Two years into Donald Trump’s mandate, and after he made several public statements of disdain towards the continent, the strategy aims to open markets for American businesses and increase trade reciprocity to curb “predatory practices pursued by China and Russia [that] stunt economic growth in Africa; threaten the financial independence of African nations; inhibit opportunities for U.S. investment; interfere with U.S. military operations; and pose a significant threat to U.S. national security interests.”[2] China has financed several high profile projects such as the Africa Union headquarters and railways in Ethiopia – Djibouti, Kenya, Angola and Nigeria, through loans and other modalities. Especially since the 2017 opening of a Chinese military base close to the permanent U.S. Military base Camp Lemonnier in Djibouti, the U.S. have been increasingly worried about Chinese initiatives gaining ground across the continent.

At the European level, Jean-Claude Juncker put a strong focus on creating a “partnership among equals” when he announced the European Union’s Africa-Europe Alliance for Sustainable Investment and Jobs in September 2018. He was echoed by the Austrian Chancellor Sebastian Kurz who, at the December 2018 High Level Forum Africa-Europe in Vienna, suggested to shift the focus from the threat of migration, which constitutes a key preoccupation of his government, towards the potential of African markets. The alliance, which focuses on the unlocking of private investments and the enhancement of economic integration and trade, comes at a time where the European Union is renegotiating its trade relations with the continent under the EU-ACP Cotonou agreement that will expire in 2020. In view of some hesitancy on the part of African countries to provide duty-free access for European products to their internal markets, the Cotonou agreement had failed to set up a full-fledged reciprocal free trade scheme between the two continents[3].

In the area of strategic investments and job creation, the Africa-Europe Alliance will benefit from financial resources under the European External Investment Plan[4] and its European Fund for Sustainable Development (EFSD) which was set up in 2017. The strategy of the EFSD is to instigate private sector investment towards “sustainable” projects by providing grants, loans and guarantees to secure their operation. As such, it is estimated that an initial contribution of €4.1 billion could mobilize €44 billion in private investment to countries where businesses would usually be hesitant to assume the risk of investing. For the upcoming 2021 – 2027 EU budget this investment framework for external action could benefit from up to €60 billion of initial investment.

Blended finance – the new mantra in development cooperation

The strategy of blending public and private funds is part of an overall move towards a greater implication of commercial and financial tools in the global development agenda. This was largely accelerated through the 2015 Conference on Financing for Development, which took place in Addis Ababa/Ethiopia prior to the adoption of the 2030 Agenda for Sustainable Development. Since then, using public funds to pull in the private sector as a miracle remedy for development has been on many lips. European Development finance institutions – development banks that are mainly government owned – have significantly scaled up their combined portfolio over the last years (from €10.9 to 37.2 billion between 2005 and 2017). As such, France is enhancing its investment programmes through PROPARCO, aiming to transform its development assistance policy into “a genuine investment policy based on solidarity”[5]. Germany, under its 2017 Presidency of the G20, has launched the Compact with Africa that aims at attracting German investors and exporters through guarantees, an investment fund and business reforms in African countries. The compact stresses once again the ambition of a partnership on equal footing and mutual benefit that should also contribute to the fight against the “root causes of migration”[6].

All of the above mentioned interventions are likely to receive an additional boost through the ongoing OECD DAC reform on Official Development Assistance (ODA), which is revisiting statistical definitions in order to allow for higher parts of investment and trade related finance to be counted as ODA. A key part of the reform involves new rules for how to report public loans, equities or guarantees provided to – EU, US or local – businesses as ODA. At a moment of stagnant ODA engagements, this may even further curtail the part of non-commercial finance that actually arrives in developing countries and can be invested by governments into their public services independently of profitable return. Initiated in 2014, progress around the calculation of such private sector instruments has been less straightforward than initially intended. Civil Society Organizations (CSO), some governments and former OECD/DAC Chairs have mobilized to safeguard the concessional character of development assistance, but recent high level decisions and the adoption of provisional reporting arrangements legitimize the reporting of large parts of contributions from development finance institutions (DFI) and the final rules may extend this further.

There is no doubt about the crucial role the private sector plays in a country’s economic and social development, namely to increase local tax revenues, reinvigorate local economies and create urgently needed decent job opportunities. There is also no doubt that many African countries and businesses are in dire need of strategic investments that promote their capacity to produce local consumption goods and contribute to global value chains. Yet, scaling up the amounts invested is no guarantee to automatically achieve sustainable results for local populations. Additional costs and the potential risks – from tax evasion to harmful social and environmental impacts that are well known for certain international investments – need to carefully appraised and mitigated beforehand.

A promising outlook for investors in Africa

The African continent is home to some of the fastest growing economies with significant potential for structural transformation, industrialization and strategic investments. The creation of an estimated 3 million formal jobs is largely insufficient for the 10 to 12 million young people who arrive in the job market every year. In 2015, it was estimated that out of 420 million youth across the continent only 1/6 had a formal salary[7].

The African Development Bank estimates that in the sole sector of infrastructure development, the continent needs to invest between US$130 – $170 billion every year. African governments are by far the largest investors in this sector (about 40% of all 2012 – 2016 investments made), but a tremendous financing gap still remains[8]. Significant gaps also exist in the agriculture and other sectors.

Nevertheless, overall foreign direct investments (FDI) have nevertheless been much lower than in other regions (2.9% of global FDI in 2017) amounting to an average of US$40 – $50 billion per year, primarily concentrated in 5 countries[9]. Despite a growing diversification away from the mining industry, which generally has very little linkage with local economies, investments into job-creating manufacturing sectors that add value to local products remain low and often limited to low-salary job opportunities[10].

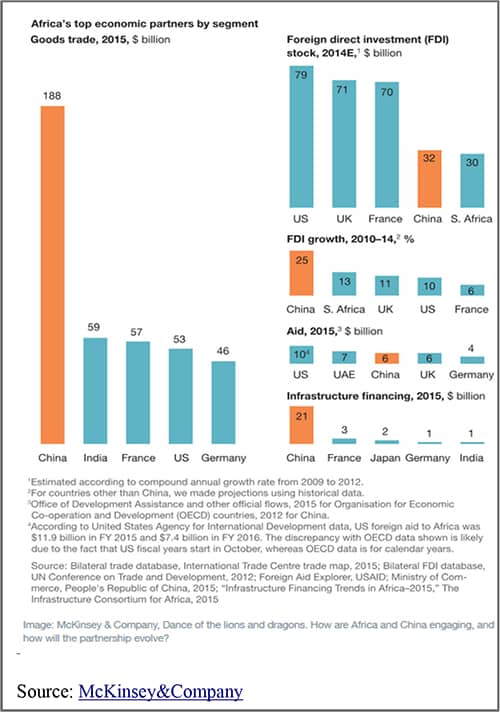

Since the beginning of the century, Chinese investors were among the first to appreciate the high rates of return[11] and large investment opportunities beyond the extractive resource sector.. While the United States and Europe (especially the United Kingdom and France) still hold the largest FDI stocks across the continent, Chinese investment stocks have increased rapidly (from US$ 16 to $40 billion between 2011 and 2016[12]) and more prominent projects are planned within the Belt and Road Initiative. Chinese companies were the top investors in 2015 and 2016, and the country is now the continent’s second trading partner right after all EU member countries combined and before the U.S.

With China’s economic transformation more and more Chinese companies are transferring their labour-intensive manufacturing industries to low salary economies like Ethiopia. A 2017 report from Mc Kinsey estimates that about 10 000 Chinese companies are operating across the continent with returns close to US$180 billion per year.

This situation clearly seems to worry European and U.S. governments, requiring them to shift gears and incentivize their own companies to enter the competition. To address the traditional hesitancy of investors to invest in higher risk economies, OECD countries have usually relied on bilateral investment treaties. African countries have concluded more than 1500 bilateral investment and double taxation treaties, especially since the 1990s and with countries outside of the continent. One of the main obligations from these agreements is to treat foreign investors the same way as their – generally less competitive – local companies. The new investment programs through USDFC and EFSD should allow investors to benefit from financial guarantees without necessarily needing to go through lengthy arbitration disputes.

Equitable partnerships and mutual benefit would require stepping out of old patterns

In February 2018, the French Government has announced its withdrawal from the New Alliance for Food Security and Nutrition. This G7/G8 initiative launched in 2012 assumes that the “path to sustainable food cannot be forged by governments alone” and aims to attract private sector investments through attractive investment rules and support from international donors. After the alliance faced wide criticism for its promotion of big agribusinesses (e.g. Monsanto and Mars …) land-grabbing and tax evasion practices at the expense of local agricultural models and food security, evaluations commissioned by the French Development Agency “AFD” found that it has failed to prevent harmful investments[13]. So far, the European Union continues to participate in the initiative, although the European Parliament has adopted a critical stance.

This is an emblematic example that the renewed race for African markets cannot only be measured through the quantity of investments, but needs to be built into a comprehensive framework of promotion and protection of local markets and revenues. Increased investments certainly represent a unique opportunity to further much needed structural changes that foster local production and job creation. Yet, it is even more important to avoid harmful patterns that cannot only deteriorate social and environmental conditions in recipient countries of investments, but also deprive governments of much needed tax resources.

Scandals such as the Panama Papers and the Paradise Papers have left no doubt that, for many transnational corporations, tax evasion and other harmful tax practices are rather the norm than the exception. Conservative estimates are that, between 2000 and 2017, the African continent lost an average of US$73 billion annually in illicit financial outflows, namely due to inefficient taxation and the abuses in trade mispricing by multinational companies. This is a long way above the continent’s inflows in official development assistance (an average US$ 50 billion/year are spent by international donors for the continent, but not all of this money effectively arrives in partner countries). Encouraged by the rules and regulations of the global financial system, bank secrecy and tax incentives in other countries who benefit from these outflows, this means that, in the final analysis, more money leaves developing countries towards the developed world than vice versa[14]. A 2016 study of an international CSO consortium found that many development finance institutions do not have the right regulations in place to prevent such harmful practices. Increasing foreign investments without addressing these underlying schemes risks exacerbating the problem, further depriving African governments of the domestic resources that are crucial for public investments in infrastructure and services.

A similar problem exists when it comes to the distinction between local enterprises and foreign companies (multinational or SMEs). Most development finance institutions have programmes for all of these investees, but the general discourse is simply about the much needed “private sector” to complement public investments. Statistics on the proportions of investments or guarantees that eventually go to local businesses are difficult to find. While the continent is rich of innovative ideas, initiatives and a young labour force longing for promising job opportunities, many local entrepreneurs have difficulties to develop and scale up their projects, as they lack access to financing or to other support. Experience in the area of official development assistance has shown that the tying of aid to companies and products from donor countries not only increases the costs of development projects by 15 to 30 %, it can also virtually destroy less competitive local businesses through unfair competition. Despite OECD DAC commitments to untie foreign assistance since 2001, in 2016 1/6 of global real ODA payments – the part of aid money that becomes genuinely available to developing countries – remained formally tied. In addition, a much higher level of ODA payments was subject to procedural restrictions that provide international companies with an unfair advantage over local businesses[15]. In addition, negotiations of new projects often offer provider countries the opportunity to strategically finance projects in sectors where their home companies are likely to have a comparative advantage.

Transparency over such unfair competition is limited in the aid sector, it becomes even more complicated when it comes to internationally subsidized investments.

The importance of local involvement into decision making structures

The alignment to national development priorities and the involvement of concerned citizens and authorities with adequate negotiation skills in the structures that decide about the allocation of international funds are some of the most fundamental elements to prevent such pitfalls and actually realize a “partnership on equal footing” and “mutual benefit” that initiatives like the BUILD Act/USDCF or the European Fund for Sustainable Development are putting forward,. Yet, Governments and civil society from partner countries hardly have a say on how subsidies and guarantees are assigned. The Strategic Board of the EFSD is essentially composed of European institutions, whereas the European Parliament, partner countries and regional stakeholders have only observer status[16].

When it comes to the new USFDC, the operational structures are supposed to be set up in the course of 2019, but experience of the past makes it very unlikely that decision making bodies will fundamentally change. The recent episode between Rwanda and the US administration around the import ban of second hand clothes, where Rwanda lost barrier free access for textile to the U.S. market because of its decision to strengthen its own textile production, has once again portrayed the limited flexibility of the U.S. administration to align to priorities of African countries for their structural transformation. All in all, African leaders might be rather sceptical about the Trump Africa Strategy’s stated goal that investments from American businesses “encourage [them] to choose sustainable foreign investments that help states become self-reliant, unlike those offered by China that impose undue costs”.

At a moment where the ongoing political narrative around a so-called migration crisis is putting pressure on European decision makers, it is more important than ever that their efforts genuinely allow for more equitable development on the African continent. While it is true that sources other than ODA offer opportunities to support the true take off of developing economies, the evidence base on the impact of blended finance remains weak and is important that new interventions and trade negotiations do not repeat the errors of the past. The harmful impacts of the privatization of public services under the 1980/90s structural adjustments still remain a painful memory across the continent. As such, appropriate regulations and decision-making structures must prevent unfair competition for weaker business partners. In the same light, impactful investments and the improvement of public social, health and educational services through increased domestic services need to become more than a mere reference in project documents. Otherwise, it will be difficult to sustain that European and U.S. Investments provide anything close to a sustainable alternative to the Chinese investments they aim to contrast.

————————————–

[1] Better Utilization of Investments Leading to Development, Act; For more information OPIC, FAQs on BUILD Act implementation, available online [consulted on 15 April 2019].

[2] Remarks by National Security Advisor Ambassador John R. Bolton on the The Trump Administration’s New Africa Strategy, 13 December 2018, [consulted on 15 April 2019].

[3] In the form of Economic Partnership Agreements, for more information see EURACTIF, EU-ACP relations after Cotonou agreement, August/September 2019 [consulted on 15 April 2019].

[4] An instrument that differs, but is seen as complementary to the EU Emergency Trust Fund for Africa which finances shorter term programmes to prevent irregular migration. For an analysis of the trust fund see Esther Schneider, Les ODD s’effacent derrière la gestion précipitée des migrations, July 2018.

[5] Author’s translation of : Conférence des ambassadeurs et des ambassadrices – Discours de M. Emmanuel Macron, président de la République, Paris, 27 August 2018 [consulted on 15 April 2019].

[6] Following the 2015 “migration crisis”, albeit the fact that only a small part of the 477 000 asylum requests in Germany came from African refugees, the German government has adjusted its Africa policy with a focus on addressing the root causes of migration (“Fluchtursachenbekaempfung”), a concept that is scientifically not proven, since economic development in its initial stage usually triggers increased mobility of populations.

[7] AfDB, Jobs for Youth in Africa , Flyer, 2016 [consulted on 15 April 2019].

[8] AfDB/OECD/UNDP, Africa Economic Outlook, 2018, p.82 [consulted on 15 April 2019].

[9] Egypt, Ethiopia, Nigeria, Ghana, Morocco in 2017; Source WIR 2018

[10] UNCTAD, World Investment Report, 2018, p.38 – 39 [consulted on 15 April 2019].

[11] African rates of return on investment was usually higher than in other parts of the world (12.3% for a world average of 8.1% in 2012 and 10.6% for a world average of 7.9% in 2014), but dropped, below average, mainly due to the commodity price drop since 2015 (UNCTAD; WIR 2018 p.6).

[12] UNCTAD, WIR 2018, p.42 [consulted on 15 April 2019].

[13] Laurence Caramel, Pourquoi la France s’est retiré de la Nouvelle Alliance pour la sécurité alimentaire, Le Monde, 12 February 2018 [consulted on 15 April 2019].

[14] A study from Froburg and Waris in 2010 estimated that for every aid dollar to the developing world almost 10 dollars are lost through illicit means. See UNECA, Base erosion and profit shifting in Africa: reforms to facilitate improved taxation of multinational enterprises, January 2018, [consulted on 15 April 2019].

[15] Polly Meeks, Development – untied, Eurodad, Septembre 2018 [consulted on 15 April 2019].

[16] European Fund for Sustainable Development, 2017 Operational Report, p.13 [consulted on 15 April 2019].